What Is a Virtual Credit Card and Why Are More People Using It?

As cross-border business, digital subscriptions and global lifestyles become more common, virtual credit cards (Virtual Credit Card, VCC) are quickly turning into an everyday tool for both work and life. Ad buying, e-commerce operations, AI tool subscriptions, overseas account registration… whenever overseas payments are involved, a virtual credit card is almost a must-have.

Yet many people still don't really know: what exactly is a virtual credit card? Is it safe? What is it actually good for? This article will walk you through everything in one go.

Register for a virtual credit card now: https://vmcardio.com/

1. What is a virtual credit card?

A virtual credit card is a credit card that has no physical plastic and exists only inside an online account. It still comes with a card number, expiry date, CVV security code and billing address, and can be used to pay normally on all kinds of overseas websites. But unlike traditional cards, a virtual card doesn't need to be tied to a local bank account, and there's no complicated approval process. It can be issued faster and with a much lower threshold.

Because it's easy to open, relatively safe and supports flexible multi-card management, virtual credit cards have gradually become the preferred payment tool for cross-border workers, ad agencies and heavy subscription users.

2. What are the advantages of a virtual credit card?

The core benefits of virtual credit cards can be summed up as:

Low threshold, easier to use

You don't need to visit a bank branch or submit piles of documents. In many cases, you just register on the platform, top up and you're ready to go. This is especially useful for users who have urgent payment needs.

Compatible with major global platforms

Many overseas platforms have requirements around issuing bank and region, so some China-issued cards often fail to charge, for example on OpenAI, Claude, AWS, Google Ads, Meta Ads, Shopify, Amazon, etc. Virtual cards usually use BINs and payment channels that are more easily accepted by these platforms, which gives them a higher success rate.

Flexible multi-card management

For ad agencies, e-commerce teams or account studios, one person almost never uses only one card. Different projects, different ad accounts and different platforms should ideally bind different cards. This helps with risk control and makes cost accounting easier. With virtual cards, it's easy to do one-person-multiple-cards or one-company-multiple-cards, and management becomes much clearer.

Higher security

You can set a limit for each virtual card and freeze or close it at any time. Even if card information is leaked, your risk is still controllable. Meanwhile, you don't need to expose your real bank card details, which is safer in complex online environments.

3. Who and what scenarios are virtual credit cards best for?

Typical users and scenarios include:

(1) People doing overseas ad buying

Whether you run Facebook, Google or TikTok ads, stable billing is a lifeline. Failed charges mean stopped campaigns, broken data and algorithm restarts. The loss is far greater than the cost of one card. With higher payment success rates, virtual cards are better suited as long-term funding sources for ad accounts.

(2) Heavy users of AI tools and overseas SaaS

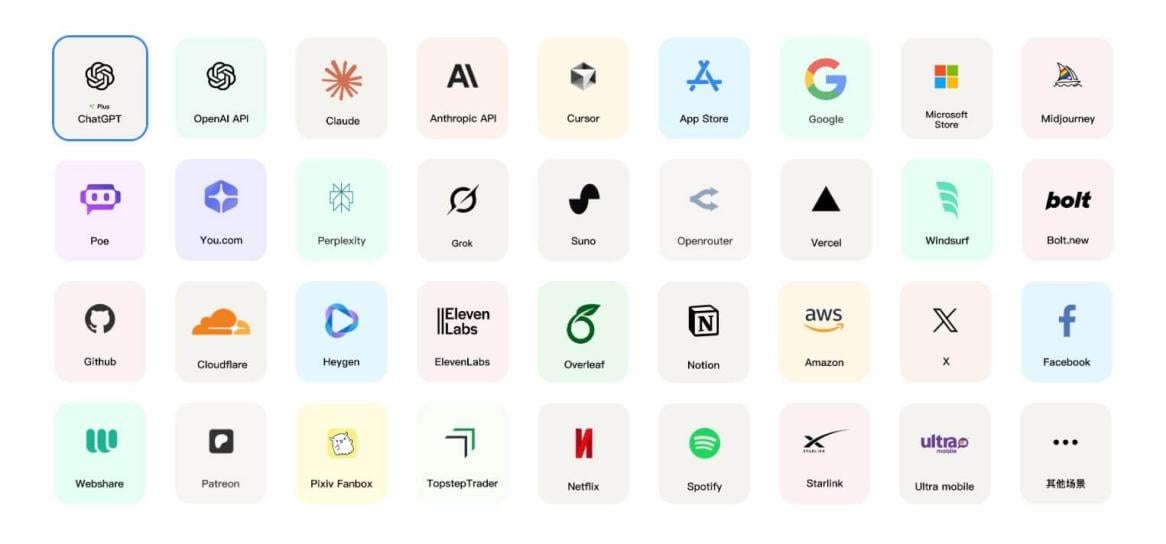

For example: ChatGPT Plus, Claude Pro, Midjourney, Notion, Figma, Adobe and other services. Many domestic users see failures or region restrictions when trying to pay with local cards. Virtual cards are more likely to pass verification and renew successfully, avoiding sudden service interruptions.

(3) Cross-border e-commerce sellers

On platforms like Amazon, Shopify and Stripe, you need a stable card for store verification, ad spending and tool subscriptions. Virtual cards can be “one card per store,” which makes management and risk control much simpler.

(4) Users who need to register and run overseas accounts

For example, registering Twitter, overseas app stores or various foreign service platforms. Some platforms do small-amount verification charges or recurring charges, and virtual cards are perfectly capable of handling these needs.

4. Are virtual credit cards safe?

For many first-time users, security is the number one concern.

In reality, in many scenarios virtual credit cards can be safer than directly using a physical credit card.

Reasons include:

– A virtual card can be dedicated to one platform or one project, achieving stronger risk isolation.

– You can set spending limits to prevent malicious multiple charges.

– If you see anything abnormal, you can instantly freeze or cancel that card without affecting other cards or your real bank account.

– You don't need to expose your real bank card information when paying, which lowers the risk of data leaks and loss of funds.

As long as you choose a compliant provider that has been operating steadily for some time, with clear rules and after-sales support, the security of a virtual credit card can be effectively guaranteed.

5. What real-world problems do virtual credit cards solve?

From a practical usage point of view, virtual credit cards mainly solve the following pain points:

(1) Frequent declines with domestic credit cards

Some platforms have strict limits on region and issuing bank, so domestic credit cards often fail to charge. Virtual cards, using more suitable channels, significantly improve payment success rates.

(2) One business system needs multiple cards

Whether it's a matrix of ad accounts, shops or projects, it's never ideal to rely on one card. Virtual cards can be issued by project, by client or by store. Management is clearer and settlement is easier.

(3) Need to top up fast and use funds fast

Traditional cross-border payments are often slow to reach the account and complex to integrate. Virtual cards, on the other hand, usually come with more efficient top-up systems, support 24/7 funding and make it easy to quickly replenish budgets during busy periods.

6. Why do many people choose a platform like VMCard?

Among the many virtual card services, some are geared more towards short-term arbitrage, while others focus on long-term, stable and sustainable business support. The latter is what you really want if you care about compliance and building a long-term business.

Take VMCard as an example. It's a virtual credit card platform focused on cross-border use cases and has been running stably for years, with the following features:

– Multiple BINs and card types that cover ads, e-commerce and subscriptions, so you can choose by scenario and improve payment success rates

– 24/7 instant top-ups, ideal for high-volume teams that need to run ads and other business continuously

– A standalone management dashboard that lets a single account manage multiple cards, which is great for team collaboration and cost tracking

– API integration for enterprise users, enabling automatic card issuing, automatic top-ups and bulk management inside your own systems

For ad optimizers, cross-border sellers and heavy AI-tool users, this kind of virtual card platform essentially becomes an extra layer of solid and flexible payment infrastructure on top of their business stack.

7. Conclusion

Virtual credit cards are no longer a niche tool for a small group of people. In cross-border ads, e-commerce, AI subscriptions and overseas account registration, they're becoming “standard equipment.” Their value lies mainly in higher payment success rates, more flexible card management, more controllable security and funding methods that better match the rhythm of cross-border business.

If your work and life already depend heavily on overseas platforms, then putting a reliable virtual credit card solution in place for yourself or your team can directly impact your efficiency and cost control. Platforms like VMCard, which focus on cross-border scenarios, support multiple BINs and offer enterprise-level management and API integration, are becoming the long-term choice for more and more teams.